Property Investing - A Rewarding Strategy to Diversify Your Investment Stock portfolio

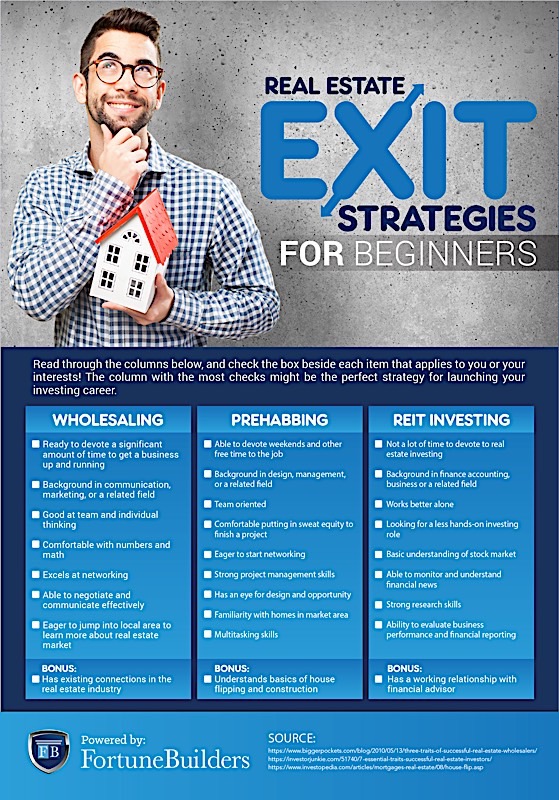

Real-estate shelling out is definitely an exceptional way to diversify your expenditure collection. But be mindful in selecting the proper home. Productive real estate buyers often use numerous strategies, which include wholesaling and business-up plans in addition they may buy REITs, much like common funds.

Real estate property ventures offer you excellent taxes and revenue benefits, assisting to minimize simple-word industry variances whilst making long term riches growth.

Area

Real estate shelling out generally is one of one of the most effective approaches for generating passive income. Lease obligations from renters provide a steady method to obtain revenue that may deal with home costs or dietary supplement an investor's present cash flow flow. Sadly, nonetheless, finding an ideal spot for your leasing house can be difficult: its desirability impacts lease prices and will boost profits tremendously.

Property ventures supply traders quite a few taxation rewards, which include devaluation and mortgage loan attention reductions. Moreover, investing in real-estate gives diversity within an investor's portfolio, which reduces risk in a down market place. Brokers that do not prefer to come to be primary property owners may opt for REITs that invest in property possessions while paying dividends back over to traders.

Ideally, when choosing the best spot for your leasing home, always keep its progress possible and distance to work locations, shopping, and enjoyment locations at heart. Public transit techniques with superb solutions will appeal to possible residents services in close proximity will help entice a bigger pool of tenants and raise income.

Place can wholesale real estate for beginners also have a main impact on a leasing property's long term benefit, specifically in centralized metropolitan areas where new homes may be limited, developing shortages in homes supply and driving a car up requirement for hire attributes in that place. When investing in central towns, make a note of their upcoming growth wants to steer clear of making errors along with your investment judgements.

If you're a new comer to real estate property shelling out, working together with an experienced professional is extremely encouraged. These specialists will help you navigate the neighborhood real estate market and recognize purchases rich in earnings on your investment. SmartVestor offers a free of charge service which fits you up with as many as five committing benefits in the area - you could find one through here too!

Real estate purchases demand finding an optimal area that will make high hire profits although appealing to an assorted pair of citizens. Mashvisor can assist in aiding find this sort of areas.

Residence type

Property ventures range from buying an individual the location of purchasing sizeable industrial buildings, all of which provides its very own list of hazards and advantages. You need to consider your amount of involvement, danger threshold, and success into account to choose the best home kind yourself. Home choices can include solitary-household houses, multiple-model properties (like flats or condos), cellular property park systems or unprocessed property investments that continue to be undeveloped but may deliver better revenue than founded qualities.

An alternative for shelling out is getting residence to rent. Although dealing with tenants and having to pay taxes on rental revenue calls for much more work, this kind of purchase offers higher earnings than other styles of shelling out and much less unpredictability in comparison with conventional investments. Moreover, functioning costs can even be deducted on the tax statements!

Business attributes, which are non-residential real estate investments, such as hotels, industrial environments . and office buildings are an excellent technique for buyers to gain steady cash moves whilst admiring house ideals with time. Furthermore, these commercial investments tend to encounter significantly less financial fluctuations and provide investors assurance during economic downturns.

Real-estate Purchase Trusts (REITs), general public companies that own a number of commercial and residential components, will also help you make investments ultimately. By getting reveals in REITs you are able to leverage indirect making an investment when still coming into real estate world as they're an easy way to begin property making an investment without all the headache that accompanies marketing personal qualities immediately.

Along with commercial and residential property investments, you might make natural property an effective tool course to get. Uncooked property typically is based on areas with excellent growth prospective and will alllow for a worthwhile come back if determined effectively. In addition, undeveloped land may often be found for low prices. Before making your selection with an undeveloped plan of property however, take care to think about all applicable zoning regulations and also prospective expenses linked to creating it like jogging electronic, normal water, and sewer collections for the web site that may confirm high-priced when considering building houses on uncooked property or making an investment in it in uncooked land - but before carrying out nearly anything it might appear sensible for yourself prior to diving in go initially!

Loans

When buying property, there are many funding alternatives available. These may involve conventional personal loans, personal funds financial loans and personal-aimed specific retirement credit accounts (SDIRAs) focused on real estate property expense. Which funding method suits you is determined by your desired goals and level of experience as well as whether you may effectively control the house oneself day-to-day managing wise. Ultimately, be sure you see how significantly money is prepared to be placed towards these kinds of venture.

Real estate investments offer an ideal method to both generate residual income and find out long term capital admiration. There are various attributes you are able to spend money on - non commercial, professional and business. Some individuals purchase one homes to create hire revenue while some select buying and reselling properties as investments yet other people spend money on refurbished residences being distributed upon completion.

Real-estate brokers in today's industry deal with increasing rivalry and higher rates, necessitating greater understanding of the industry by and large and having the capacity to establish prospective options and dangers. To succeed in today's real estate property market, it really is imperative that real-estate brokers have these kinds of knowledge.

To be successful in actual residence shelling out, you have to have both the correct attitude and crew in place. Be prepared for unexpected charges like upkeep service fees or vacancies last but not least, generally have a backup strategy ready if your market changes against you.

Fund your property utilizing lender lending options or home mortgages, but there are additional alternatives like buying property purchase trusts (REITs). REITs very own and deal with real estate components when spending out benefits with their shareholders - supplying another income.

An increasingly preferred method of loans real-estate is crowdfunding platforms, which connect programmers and brokers by providing financial debt or equity assets with an arranged fee. Although these assets might be more dangerous and illiquid than classical methods, they may offer diversity benefits inside your profile.

Property expenditure funds provide another harmless means for buying qualities this purchase vehicle pools together numerous investors' cash to acquire multiple properties right away, providing you with access to much more qualities when generating passive income than investing directly in one house.

Routine maintenance

Real-estate expenditure is an appealing selection for those trying to find residual income. Real estate provides several income tax and diversity pros however, buyers needs to be conscious for any servicing bills which might affect all round results on investment additionally, hire attributes need important time and energy assets.

On the primary of each purchase is sustaining good conditions in a residence. Doing this can increase its importance and bring tenants in, minimize vacancies, reduce functioning charges and make sure normal assessments take place as part of a upkeep plan.

Real-estate can be physically looked at to help traders assess its top quality and find out its suitability being an expense chance. Moreover, this assessment can determine any architectural troubles or other worries which could minimize house ideals.

Real estate property shelling out offers several specific advantages, such as income tax deductibility for home loan fascination payments, home taxes and repairs expenditures. This will drastically decrease income tax liabilities while simultaneously increasing profits. Additionally, assets typically provide great income runs - an appealing function to your buyer.

Real estate committing requires considerable upfront capital and can be inelastic therefore, it might take more hours for returns on investment in the future through furthermore, getting tenants during financial downturns may prove difficult.

Diversifying an actual property profile is additionally truly essential, shielding brokers against market place imbalances and minimizing the potential risk of burning off funds. Achieving this requires diversifying across numerous home varieties, markets and geographies - for wholesaling houses step by step instance making an investment in both commercial and residential qualities boosts one's chances of making a revenue.,